30+ Amortization payoff calculator

Or our Credit Cards Payoff Calculator to schedule a financially feasible way to pay off multiple credit cards. Effective Ways to Pay Off Credit Card Debt Faster.

Tables To Calculate Loan Amortization Schedule Free Business Templates

Microsoft Excel Loan Calculator with Amortization Schedule.

. The AARP mortgage calculator can help you do just that. The fact is that making a commitment to repay your mortgage in 10 20 or 30 years is a good choice. You pay off your reverse mortgage in full 5.

Enter an amount between 0 and 30. This refinance amortization calculator should only be used to estimate your repayments since it doesnt include taxes or insurance. Some of Our Software Innovation Awards.

Most personal loans range from about 6 to about 30 APR. With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy. It offers payment details and amortization tables with principal interest breakdowns.

The less debt you have the more you can invest in your future. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. Amortization is the process of paying off debt with a planned.

All credit card calculators. You have a remaining balance of 350000 on your current home on a 30-year fixed rate mortgage. If youre unsure of what to put here look at.

Guide published by Jose Abuyuan on January 13 2020. 30-Year Fixed Mortgage Principal Loan Amount. Mortgage Payment Calculator Calculators Mortgage payoff calculator.

Interest rate APR The annual percentage rate for this line of credit. You can even print out the handy payoff amortization schedule to track your progress. This information is provided to you on your amortization statement which is what you will see at.

If youre not sure how much extra payment to add to payoff your mortgage by a given date try this mortgage payoff calculator here to figure the payoff in terms of time instead of interest saved. The Credit Card Payoff Calculator gives you the tools you need to set a reasonable time-frame for paying off your credit cards. Examples of other loans that arent amortized include interest-only.

See how those payments break down over your loan term with our amortization calculator. Longer term payment schedules make take 30 seconds or more to appear on your screen. Why you need a wealth plan not a financial plan.

Free mortgage payoff calculator to evaluate options to pay off a mortgage earlier such as extra payments bi-weekly payments or paying back altogether. Try this free feature-rich loan calculator today. This amortization calculator returns monthly payment amounts as well as displays a schedule graph and pie chart breakdown of an amortized loan.

Line of Credit Payoff Calculator will help you estimate how much you may be able to borrow against your home equity. Credit card payoff calculator. Use our amortization schedule calculator to estimate your monthly loan repayments interest rate and payoff date on a mortgage or other type of loan.

This is how much can be saved. The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. A person could use the same spreadsheet to calculate weekly biweekly or monthly payments on a shorter duration personal or auto loan.

Car loan calculator with amortization schedule and extra payments to calculate the monthly payment and generates a car loan amortization schedule excel. The total sum of all your payments will be 250000 - the amount needed to pay off the principal in full and the accrued interest. Date Interest Principal Balance.

The calculator determines that youll pay 50000 in interest. By default this calculator is selected for monthly payments and a 30-year loan term. The mortgage payoff calculator helps you find out.

You will also get an amortization table showing the rate at which your payments will decline and your. Then enter the loan term which defaults to 30 years. For example a one-time additional payment of 1000 towards a 200000 30-year loan.

We used the calculator on top the determine the results. 30 Year Annual Amortization. Since its founding in 2007 our website has been recognized by 10000s of other websites.

Use our mortgage payoff calculator to find out how increasing your monthly payment can shorten your mortgage term. If you have credit card debt youre one of thousands of Americans. Click the View Report button to see a complete amortization payment schedule and how much you can save on your mortgage.

You decide to increase your monthly payment by 1000. Credit Card Amortization Calculator. 15 vs 30 yr.

To show you how this works lets compare two 30-year fixed mortgages with the same variables. To use the early payoff mortgage calculator simply enter your original loan amount when you first received the loan along with the date you took out the home loan. On a traditional loan you typically have a structured 30-year repayment and the amortization schedule will show a balance that decreases with each payment.

Every financial institution will disclose its minimum and maximum APRs. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals. Payment Date Payment Interest Paid Principal Paid Total Payment Remaining Balance.

The Early Loan Payoff Calculator is another loan payoff calculator that will help you figure out how much extra to pay each month to pay down the loan by a desired years or months. By printing out the amortization table with the extra amount that I could pay each month I was able to compare different scenarios including different interest. Whether you are buying an used car or finance for a new car you will find this auto loan calculator come in handy.

Freddie Mac During that time youll pay 200000 in principal plus another 125325 in interest for a total. You may also enter 360 months for a 30-year loan or 15 years for a 15-year fixed or 180 months depending on loan type desired. Home financial.

Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize. The mortgage amortization schedule shows how much in principal and interest is paid over time.

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

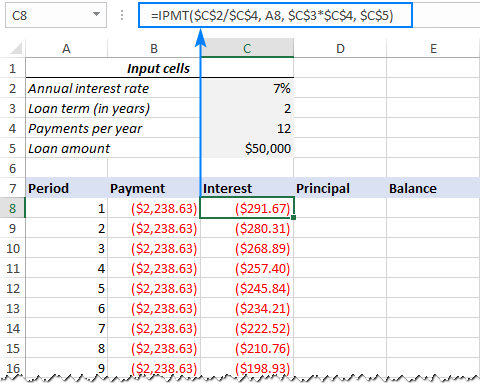

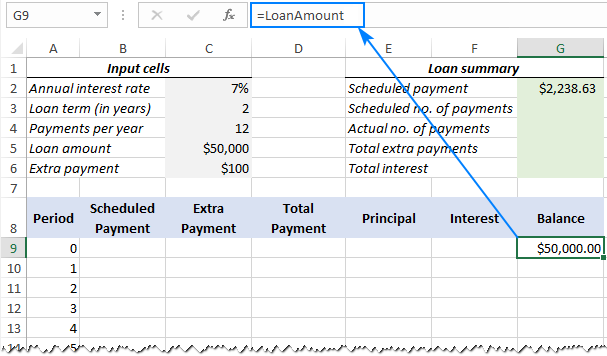

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Loan Amortization With Extra Principal Payments Using Microsoft Excel Amortization Schedule Mortgage Amortization Calculator Money Management Advice

Advanced Mortgage Payoff Calculator R Daveramsey

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Amortization Schedule Amortization Schedule Car Loan Calculator Mortgage Amortization Calculator

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

On A 30 Year Fixed Mortgage Would It Be Possible To Make Additional Principle Payments To End Up Paying Interest Equal To A 15 Year Mortgage Quora

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

Mortgage Calculator Mortgage Calculator Reverse Mortgage Amortization Calculator Revers Mortgage Amortization Mortgage Amortization Calculator Online Mortgage